No optimistic picture is being painted about the future of Canada’s economy. Supply chain challenges have lowered economic prospects, and if extended to the global snapshot, it would appear we are watching one of the most exciting slow-motion unravellings of a worldwide marketplace in modern history. How could this be exciting, you ask? How could this be a positive? Well, it all depends if you see, like I do, the extraordinary amount of opportunity that lies ahead. Let me explain.

Some economists question whether Federal Reserve Chairman Jerome Powell and his romper room classmates are making the same mistake as their counterparts in the 1960s. If you were part of that generation, you would no doubt recall the nightly news talking about inflation and food prices, rising oil costs and mortgage rates that might reach double digits and the stories of gold and silver-Hold on to this thought.

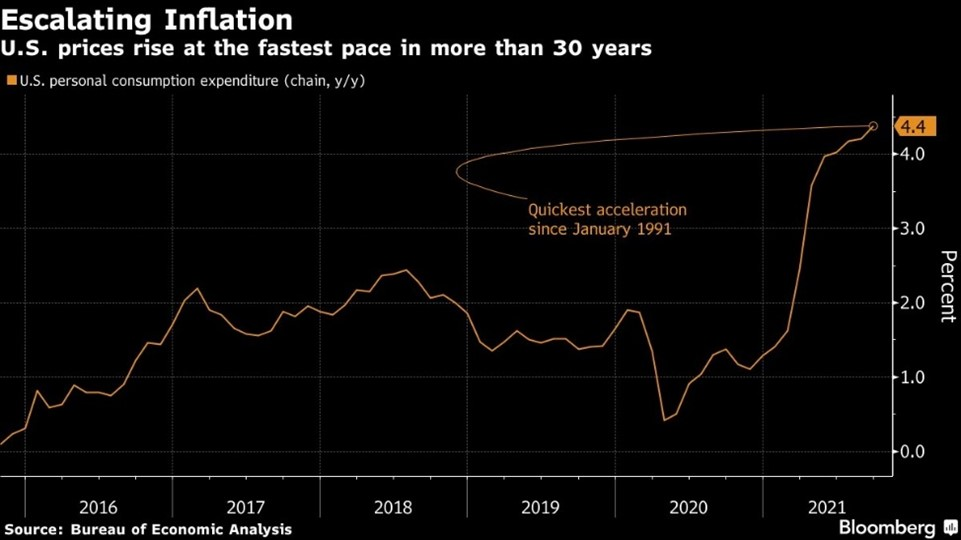

In the latter half of the 1960s, U.S. economic policymakers underestimated how hot they could run the jobs market without fueling inflation. The miscue paved the way for an economically devastating wage-price spiral the following decade. Let’s fast forward to the now so-called “transitory” inflation situation of 2021.

The CPI measure of inflation in Canada and the U.S. is as spurious as a Dundas Square Rolex — everyone knows that on Bay Street and Wall Street.

The Bureau of Labour Statistics (BLS) is a creative writing team in the U.S., which matters to the global economy. If you look at the real Chapwood Index or the way CPI was measured honestly in a pre-Greenspan period, they are already looking at 10%-11% inflation in the U.S., and here we are looking at about 8%-10%. Central Bankers in Canada and the U.S. are aggressively pushing for a return to the pre-pandemic labour market of half-century-low joblessness despite extensive worker shortages, rising wages and surging inflation.

“We could hit full employment earlier than people expect,” said Ethan Harris, head of global economics research at Bank of America Securities. “The risk of seriously overshooting the Fed’s 2% inflation target has grown a lot.” Let’s see.

Because portions of the economy show better than expected growth patterns, we now know that the Federal Reserve will be scaling back their massive bond-purchasing program. Wrapped up in all of this “best-case” scenario is the fact that Powell and the other heads of Central banks worldwide anticipate and pray that the supply chain kinks that have developed worldwide will soon be sorted. But that is a lot to ask.

Official inflation is now 5.4% in the U.S. and is expected to rise, while it is nearly 4.5% in Canada. Suppose you are a user of pretty much anything right now. In that case, you know everything from gasoline to natural gas, cars to housing, food to commodities and pretty much the bulk of everything has risen much further in a short period. Both here and in the U.S., inflation has grown faster than any other period since the early 1990s.

“We can be patient” in raising interest rates and “allow the labor market to heal,” Powell told a virtual panel discussion on Oct. 22. But is this the case? I’m afraid I have to disagree, and many of my colleagues do too.

Lack of response is going to tear our economy at large wide apart. If you play by the current history rules, then the “too big to fails” will all be protected, save perhaps one or two who are juicy “Lehman-like” pics for destruction and pennies on the dollar grabs by more prominent firms and elites, and you arrive at probably one of two places. Either this is of no concern to you at all, or it terrifies you. If you find yourself in the latter group, hard assets like gold and silver can be fantastic for diversification and wealth growth, especially during these uncertain periods.

And so, it’s extraordinarily deceitful for policymakers to make-believe that this is going to be transitory inflation. The weapon they have, though, is the ability to control the information through conspirators like the Bureau of Labor & Statistics (BLS) and here in Canada through Stats-Can to make up the inflation numbers as they go. And they’ve been doing that for years, but you can’t hide what people see at the grocery store, the gas station, the car lots, the housing markets and so forth. You can’t hide what people see and experience firsthand in real life.

And then, when that inflationary reality becomes undeniable, gold and silver (as they now appear to be doing) will finally break the faith of this false monetary system and rip wide open. This is why we feel so strongly about making gold and silver part of your wealth strategy. Even if gold and silver are a small part of your strategy, there is still a sense of value and long-term prosperity underpinned by history with both metals. As always, consult those you trust before investing in anything, but given our most recent data, it is understandable if you get as excited as we are at Delta Harbour!

Yours to the penny,

Darren V. Long