The Delta Difference

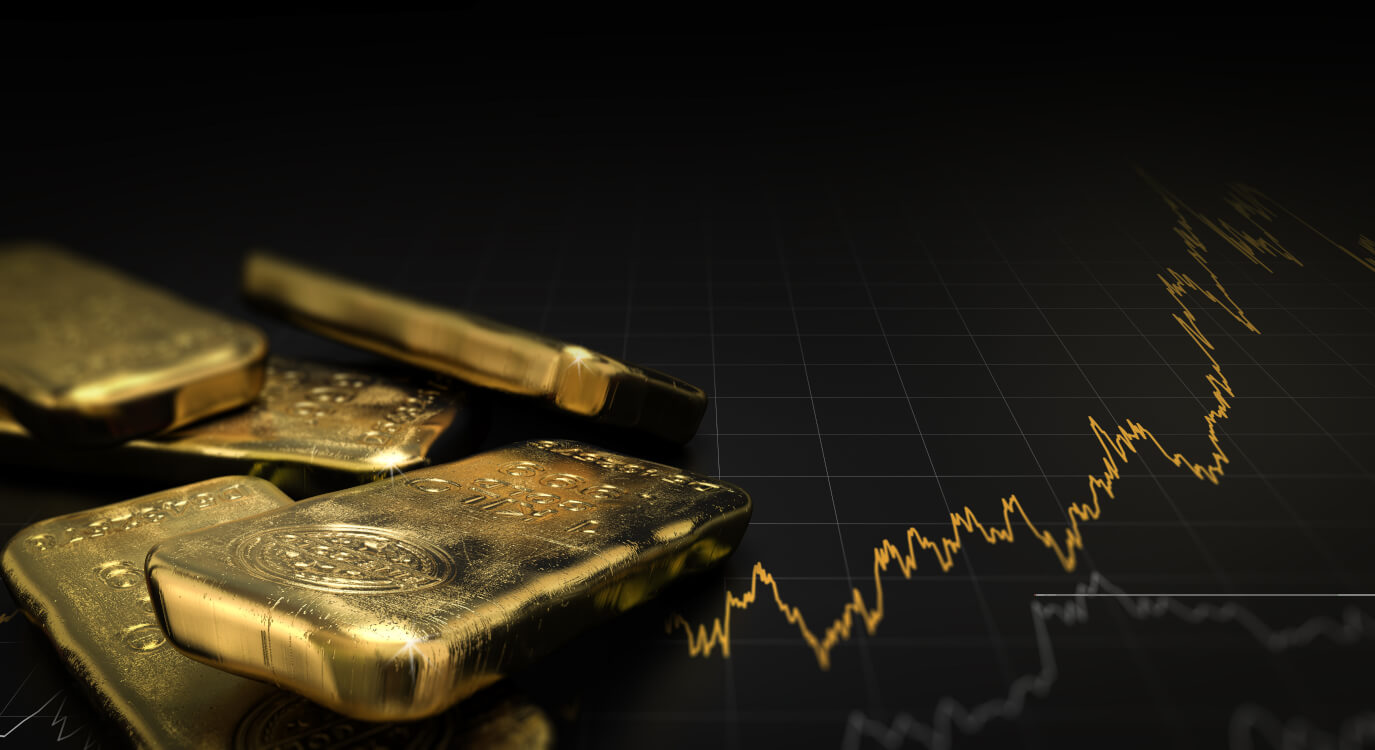

Physical gold, silver and other precious metals are world-class assets that will help you protect your hard-earned money through diversity and grow your savings. At Delta Harbour, we give you the best service, top quality products, and amazing prices. That is the Delta Difference.

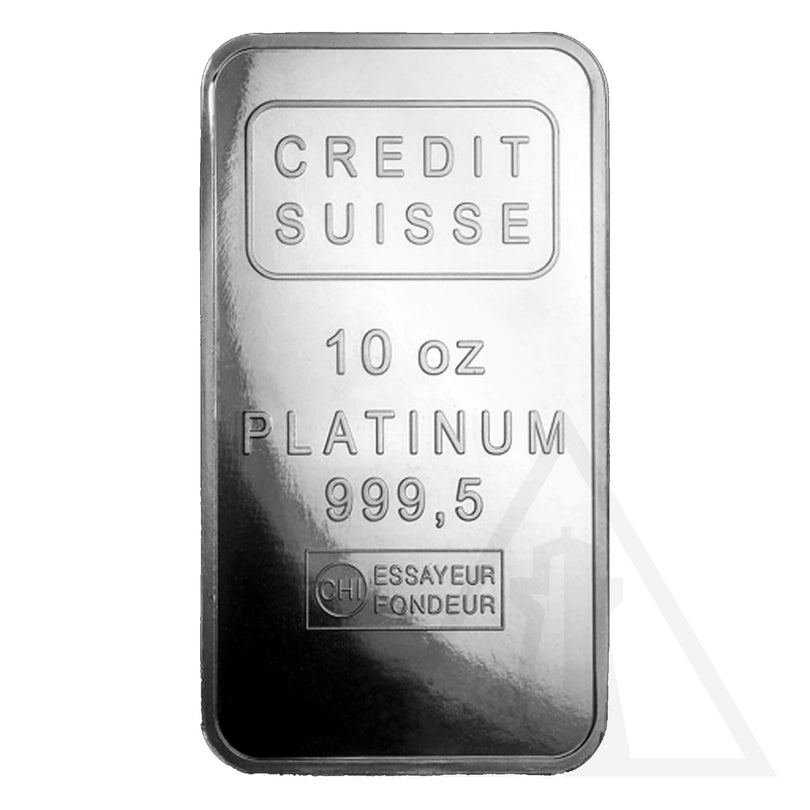

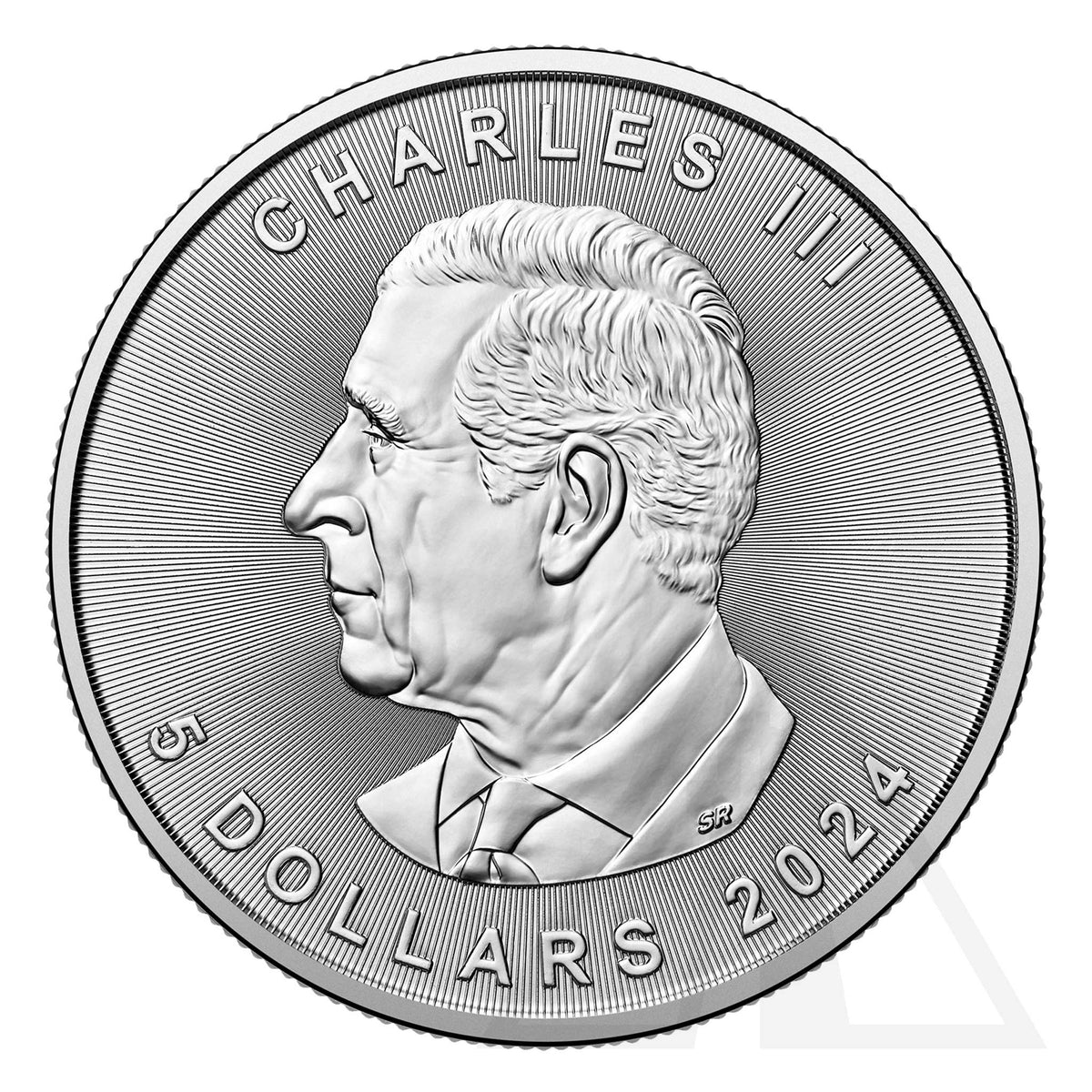

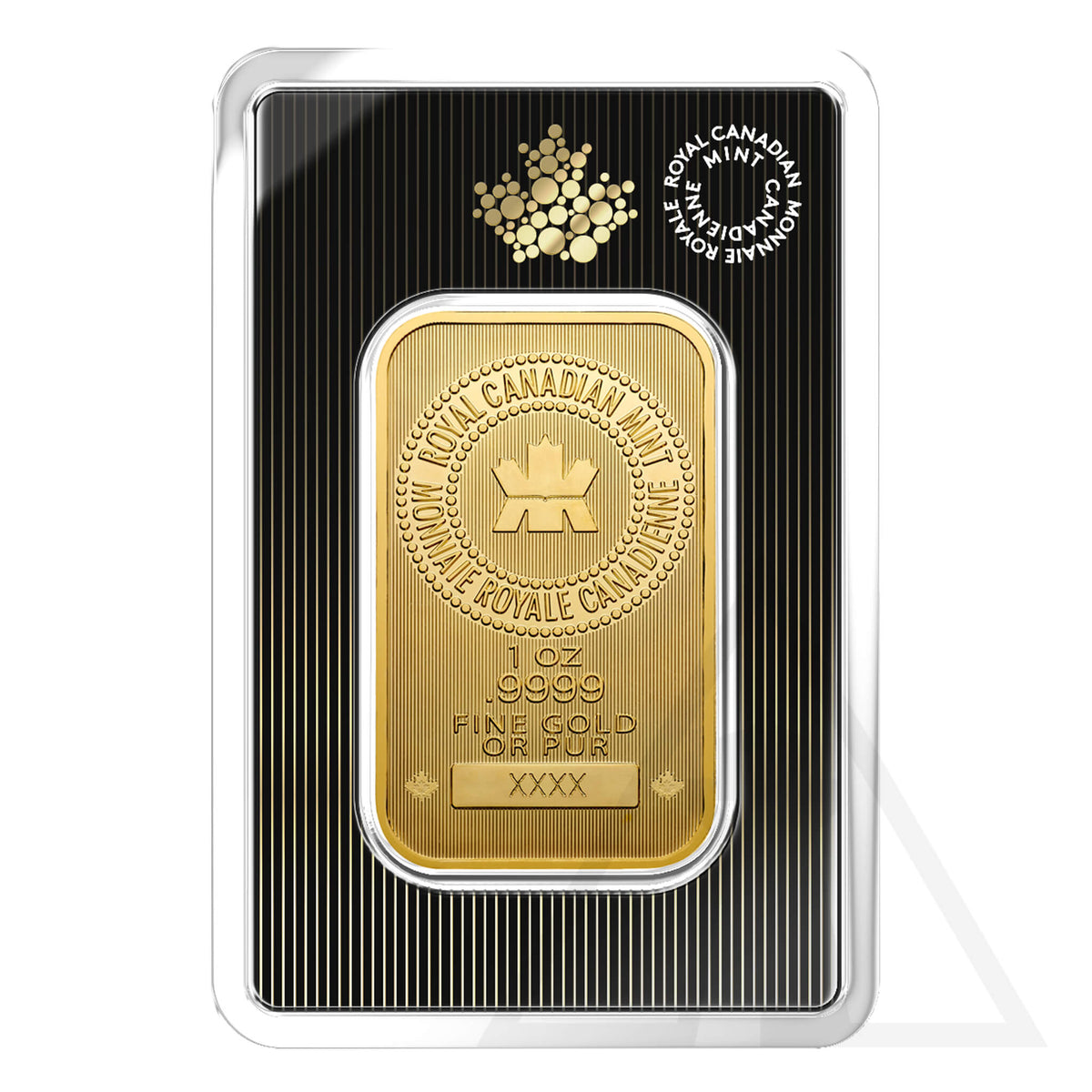

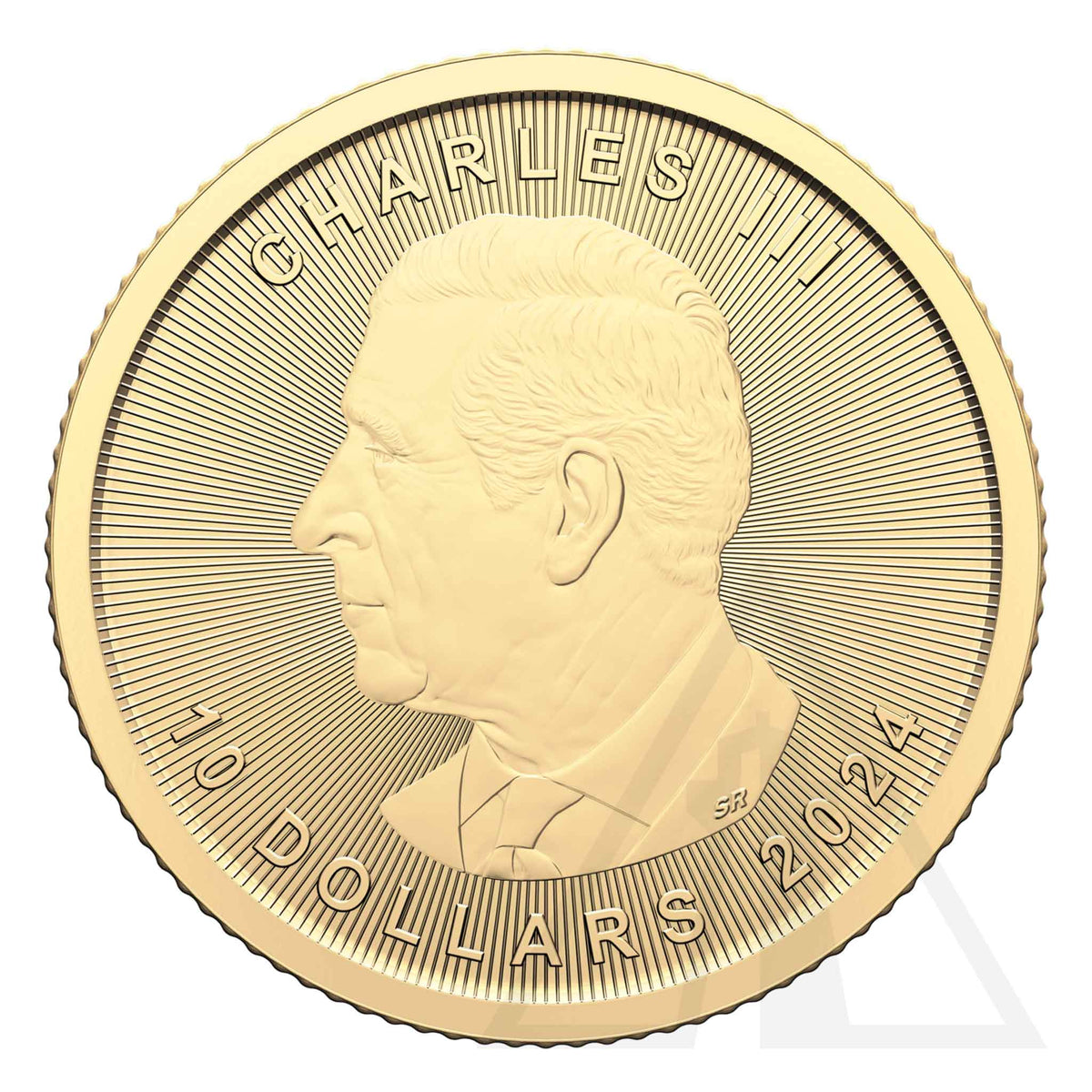

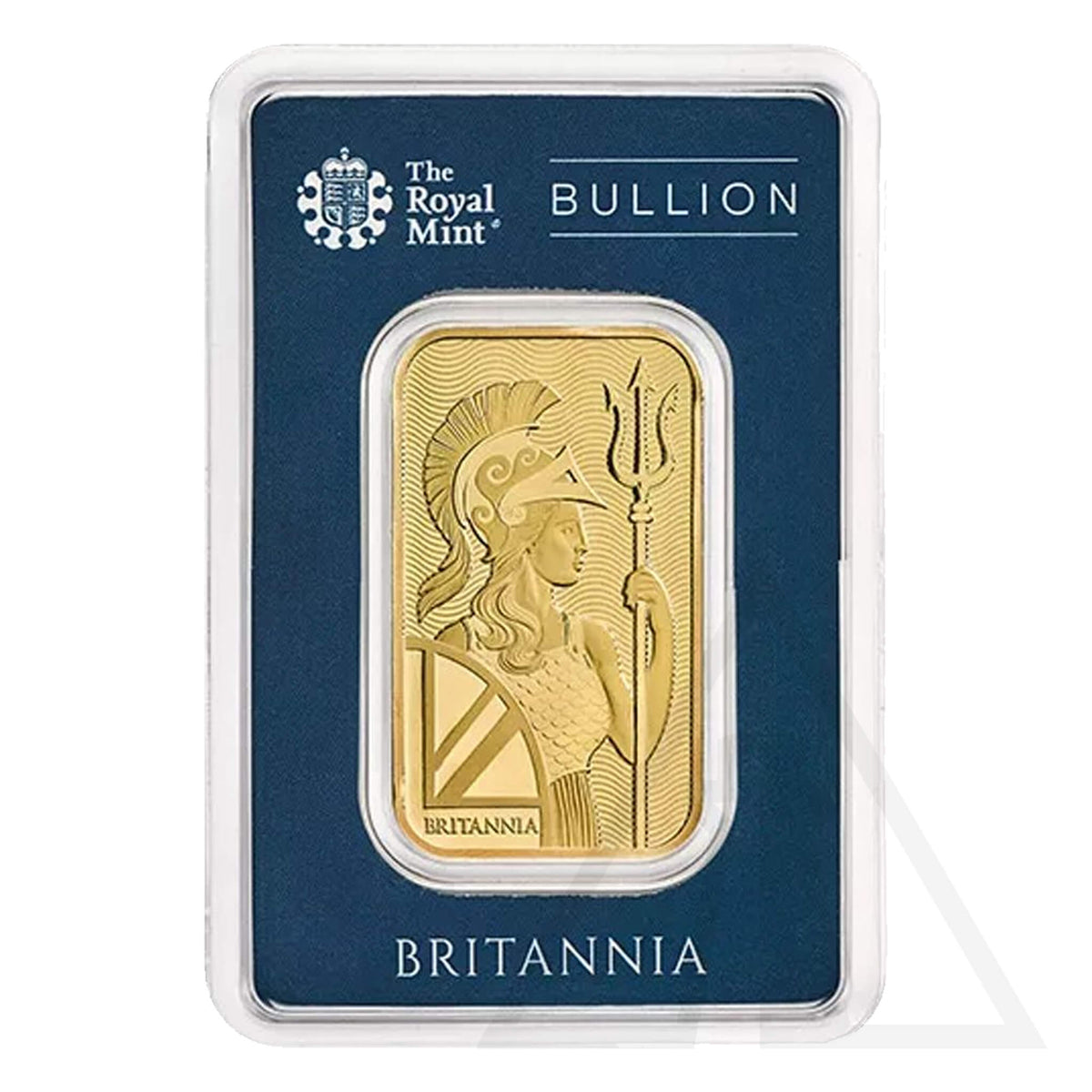

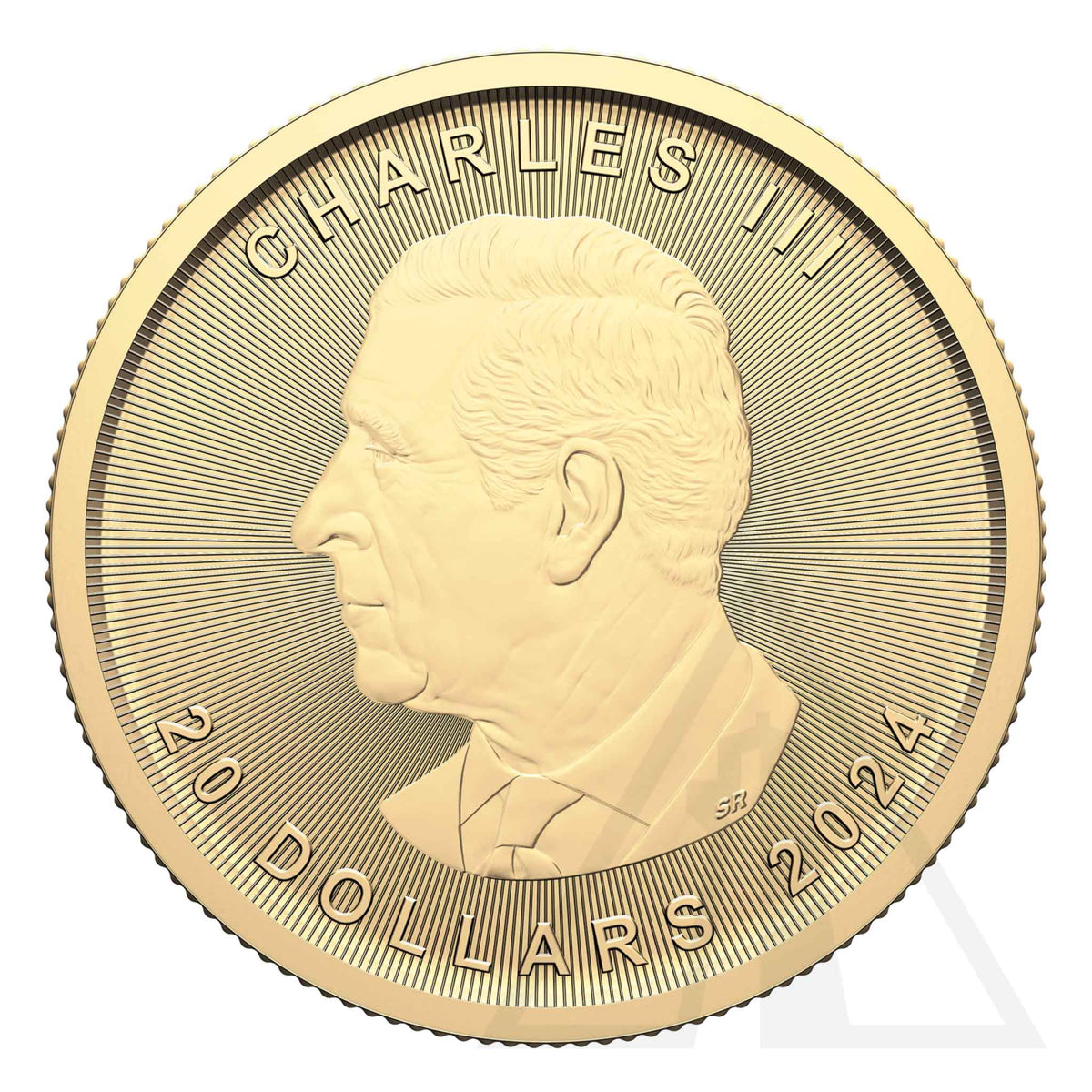

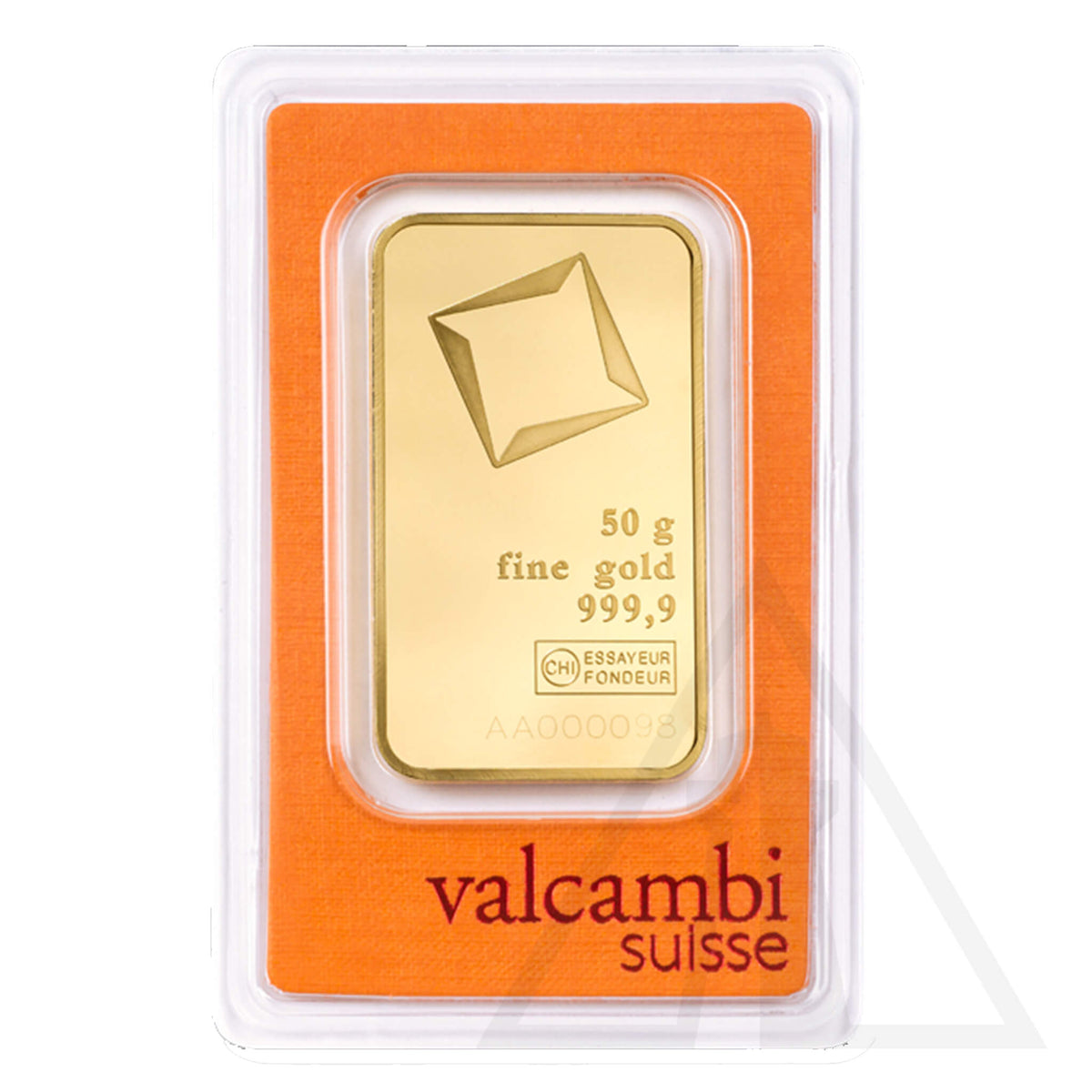

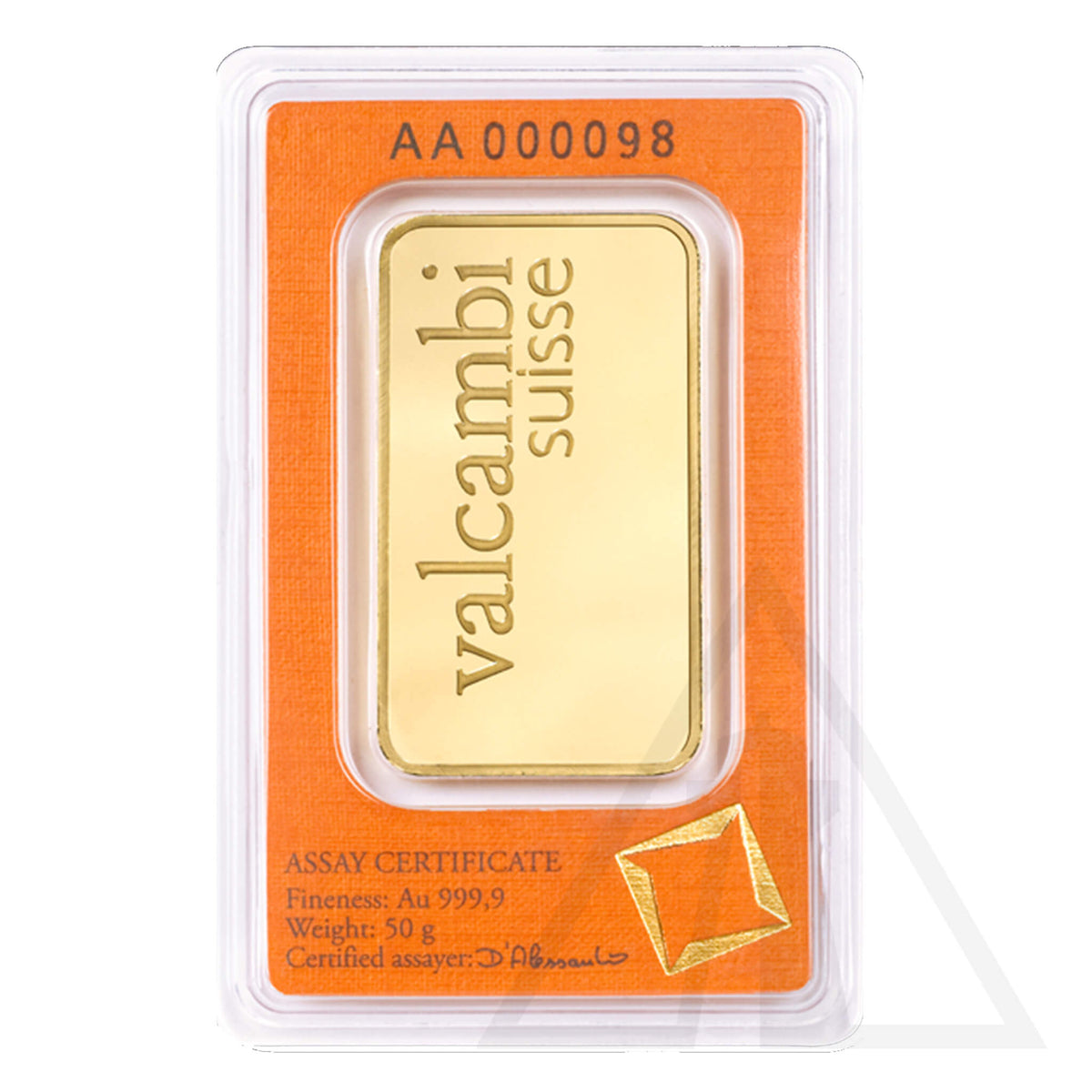

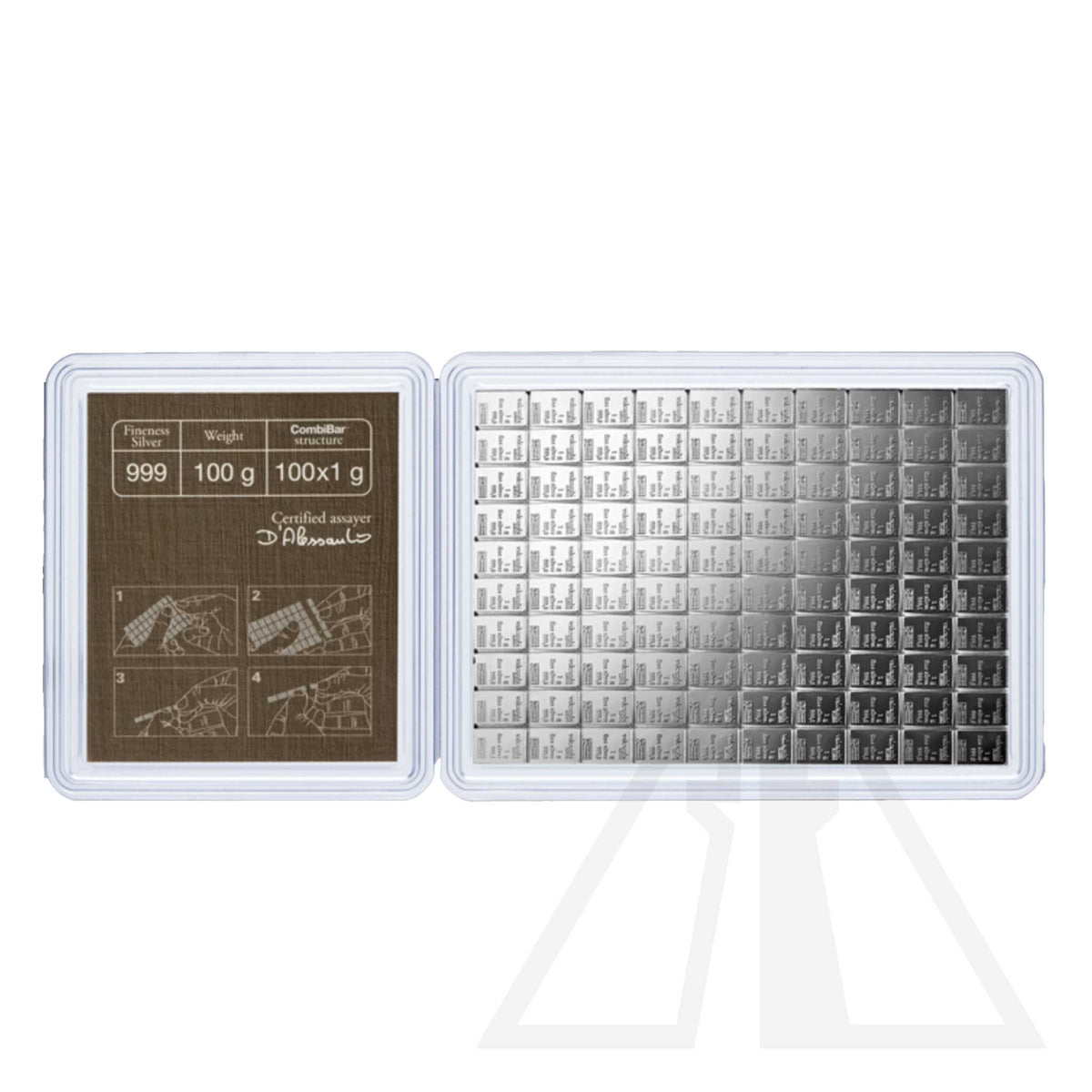

Featured Products

This Week on Hard Money

"Cryptos Burn"

A couple of tweets wiped out billions in crypto value this past week, and the exchanges are playing around with your funds. They have proven to be a speculative asset that clearly does not hedge against inflation. Invest at your peril. Tune in this week and find out how #Gold and #Silver can protect your wealth, and is actually backed by something real.

latest articles

Customer Reviews

The Delta Difference

Delta Harbour Concierge Service

Tap into our 20 years of experience and let us walk you through our products and solutions, and answer any questions you have about diversifying your portfolio.

At a time that works for you.